Safwa Islamic Bank is interested in providing you with all banking information and banking terminology that will help to enhance banking and security awareness and understand the significance of saving, in addition to recognizing the importance of using modern technology in all your banking transactions.

Your News

Safwa Islamic Bank and Iraqi Islamic Bank Sign Strategic Partnership Agreement

Following earlier announcements, Safwa Islamic Bank and the Iraqi Islamic Bank have officially signed a partnership agreement during a ceremony at Safwa Islamic Bank’s Head Office in Amman on 26th, January 2025. The partnership signing ceremony was attended by key officials, including Dr. Mohammed Abu Hammour, Chairman of Safwa Islamic Bank; Mr. Ahmed Waleed, Chairman of the Iraqi Islamic Bank; Mr. Basem Salfiti, Chairman of Bank al Etihad; Mr. Samer Tamimi, CEO of Safwa Islamic Bank, along with executives from both institutions.

Dr. Abu Hammour highlighted the significance of this agreement, noting that it aims to drive a positive shift in Islamic banking within the two neighboring countries: Jordan and Iraq. This collaboration marks the start of a strategic and commercial partnership in which both banks will share their expertise in banking and finance. The partnership is expected to strengthen their financial positions by leveraging their combined experience to deliver a broad range of banking services and financing solutions to the growing Iraqi market, in alignment with Iraqi Islamic Bank’s 33 years of experience and established credibility.

Highlighting that this partnership introduces the expertise of a leading Islamic banking institution from Jordan to the Iraqi financial sector, Mr. Waleed welcomed Safwa Islamic Bank’s involvement as a shareholder. He emphasized that this partnership reflects the growing confidence in Iraqi banking institutions regionally and noted that the collaboration would promote development, enhance financial investment opportunities, and increase trade exchanges between the two countries.

Meanwhile, Mr. Tamimi accentuated the importance of this strategic partnership, highlighting its potential to expand investment opportunities and deepen ties between the banks. He noted that the agreement sets a clear path toward a prosperous and productive commercial relationship, aiming to achieve positive financial outcomes and further strengthen the financial standing of both institutions.

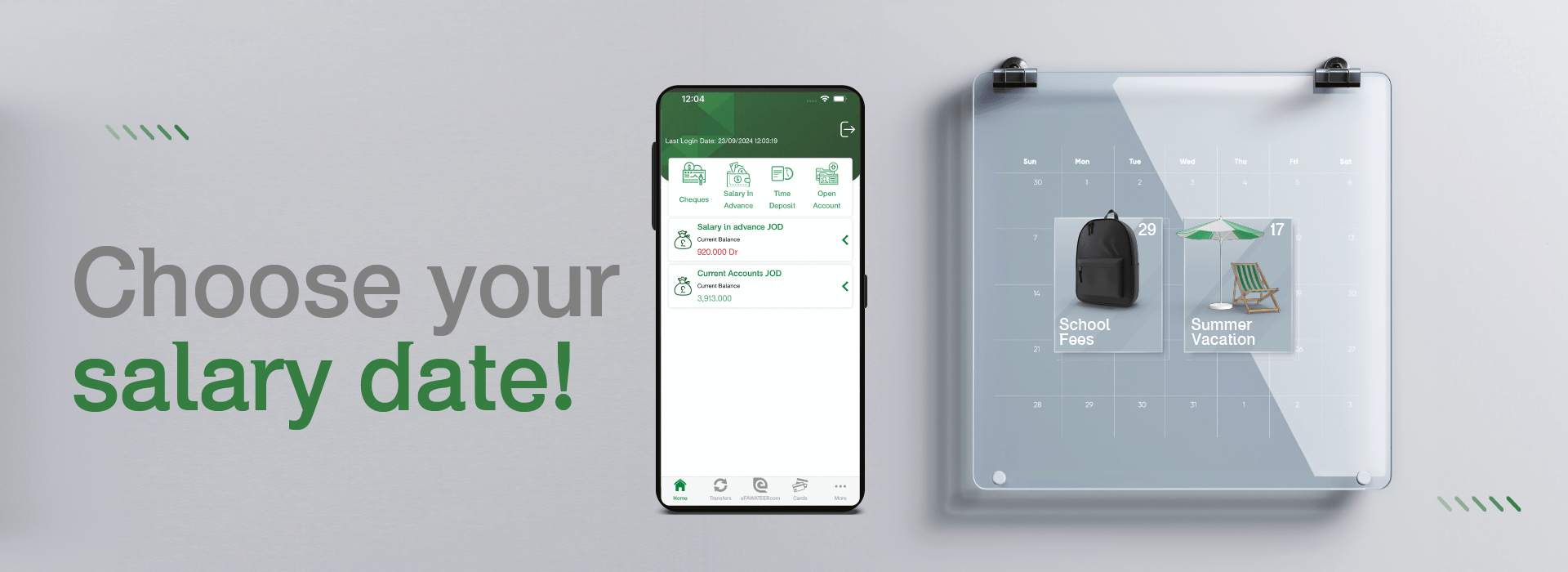

Safwa Bank Introduces “Salary in Advance” Service

23/09/2024

Set your salary date in advance at any time during the month through the Safwa Mobile App, where you can receive an advance of up to 75% of the average net income transferred over the last 3 months. This service helps you meet urgent financial needs without waiting for your official salary date.

For more information, click here.

Welcome to our new branch in Zarqa – Rusaifa

Safwa Islamic Bank has inaugurated its 44th branch in the Kingdom, located in the northern mountain in Rusaifa—one of the most active and dynamic cities in terms of commerce and industry.

The opening of the Rusaifa branch comes as part of the bank’s expansion strategy, through which it aims to enrich and enhance its network of channels across the Kingdom.

Corporate Deposit Card (CDC)

08/05/2024

This service enables companies to easily and securely deposit money through ATMs. The CDC can be used by company representatives for easy deposit into company accounts and it’s dedicated solely for depositing, it cannot be used for withdrawal or balance access.

The Corporate Deposit Card provides you with easy and effective money flow management, as well as access to deposit transaction details through E-Services with utmost simplicity. Read More

Safwa Islamic Bank Launches Contactless Payment Technology (NFC)

22/04/2024

Safwa Islamic Bank is committed to enhancing customer convenience. That’s why we have upgraded several ATMs with contactless payment technology (NFC), allowing you to easily make withdrawals and deposits by simply tapping your NFC-enabled cards or Apple Pay-enabled mobile devices on our machines.

Experience an exceptional level of profit return by opening an Offset account through Safwa Mobile

18/04/2024

Experience an exceptional level of profit return by opening an Offset account through Safwa Mobile, with potential savings of up to 100% on your housing finance profits by opening an Offset account through Safwa Mobile today. The greater your savings, the greater the recovery percentage, in accordance with the standards set by the bank.

To know more, click here

New “Offest” Account

28/2/2024

Safwa Islamic Bank is pleased to announce the launch of the new “Offest” account, which allows you to return a percentage of the profits calculated for your housing financing. The higher your savings balance, the higher the return percentage, according to specific criteria set by the bank. For more information, please click here.

Newly Constructed Al Muqabalain Branch – Al Quds Street

14/1/2024

Safwa Islamic Bank is glad to welcome customers to Al Muqabalain branch – Al Quds Street, 5B Mall, the newly constructed branch that provides comprehensive banking services in a modern and advanced way.

Launching Apple Pay Service for Safwa Islamic Bank Cards

14/11/2023

Apple Pay service has been launched for all types of Safwa cards, providing payment service through all iOS devices, in line with the bank’s strategic plan to offer a distinctive customer experience. For more information about the service, please visit the link.

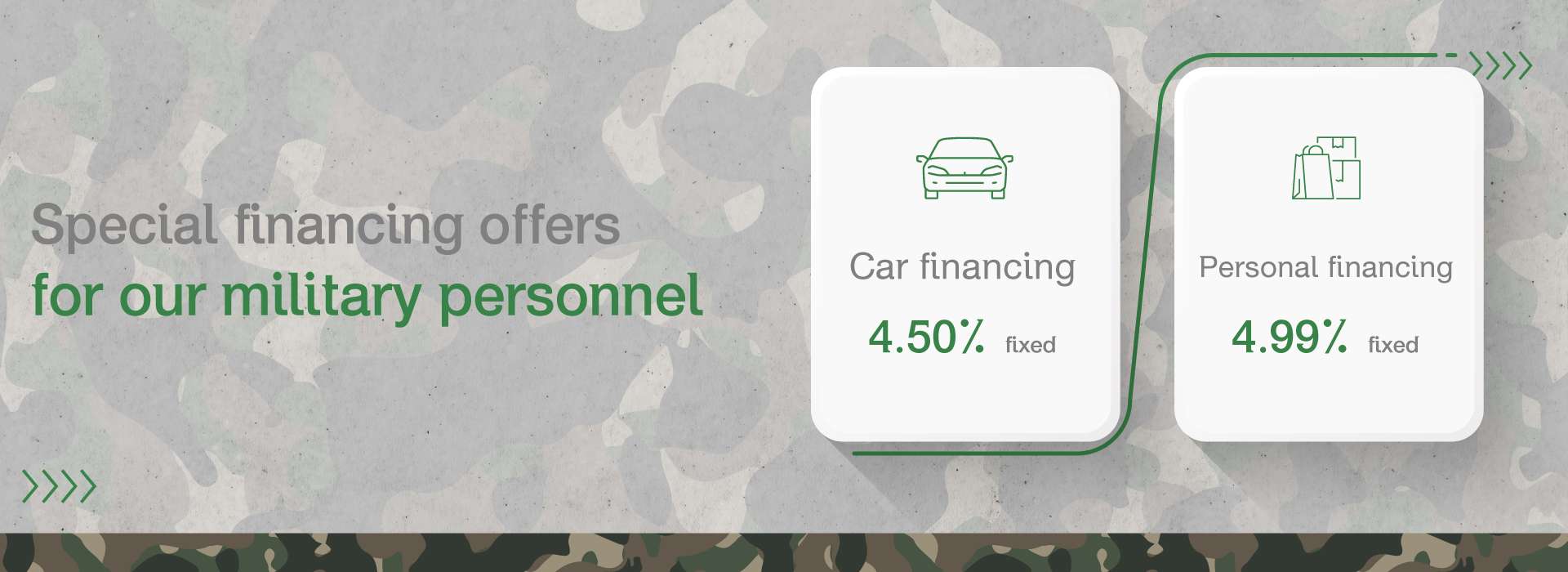

Exceptional Financing Nation Protectors at Security Departments

01/06/2023

In appreciation to the protectors of our precious nation at all security departments, Safwa Islamic Bank extends preferential prices for all types of financing.

Exceptional Financing for All Teaching Staff (Schools and Universities)

01/06/2023

With the beginning of the summer holiday, the financing offers have been extended for all teaching staff at schools and universities with competitive preferential prices.

Safwa Mobile Application Update with New Features and Characteristics

19/06/2023

With its new update, Safwa Mobile includes a range of features and characteristics that enable customers to manage their banking accounts easily and securely.

Safwa Mobile grants the ability to request an ATM card for all customers who opened their accounts through the application, in addition to enabling customers to manage their ATM cards, including activating and blocking the card, setting the financial transactions, and reviewing the card information, as well as considering the improvement of customer verification when using the electronic services to increase protection, depending on verifying the customer’s civil ID and ATM card.

Welcome Newly Constructed Shmeisani Branch – Ash Sharif Abdul Hamid Sharaf Street

15/06/2023

Safwa Islamic Bank is glad to welcome customers to Shmeisani branch – Ash Sharif Abdul Hamid Sharaf Street, Building No. 24, the newly constructed branch that provides comprehensive banking services in a modern and advanced way.

The specialized Al-Shams Company and Safwa Islamic Bank Signed a financing agreement worth 70 million dinars to implement the solar energy project for the industrial sector

23/02/2023

Al-Shams Company, which specializes in renewable energy, signed a financing agreement with Safwa Islamic Bank to implement a project to establish a solar power plant with a total value of 70.5 million dinars, with a capacity of 135 megawatts, using the system of renting on the main grid, to provide the industrial sector with a capacity of 318 gigawatt-hours / year of clean and generated energy. from solar energy.

The agreement was signed by the Chairman of the Board of Directors of the company, Engineer Abdullah Shawabkeh, and the CEO of the bank, Samer Al-Tamimi, in the presence of the President of the Jordan and Amman Chambers of Industry, Eng. Fathi Al-Jaghbir, the General Manager of the Philadelphia Solar Company, several members of the Chamber’s Board of Directors, and representatives of the executive management of the bank and Shams Company.

Shawabkeh said, “the project aims to provide electric power to factories at preferential prices, which enhances the competitiveness of national industries in the domestic and export markets.”

Showing that the Shams Company, specialized in renewable energy, has 84 industrial companies from various sectors, as it was established on the initiative of the Amman Chamber of Industry.

He stressed that the project will save more than 20 million dinars in annual electricity consumption for the industrial sector, and he expects the project implementation period to range from 18 to 24 months.

Al-Tamimi said. “Safwa Islamic Bank will finance according to the Central Bank’s program to support economic sectors, including the energy sector, as he appreciated the role of the Central Bank in this regard and stressed the importance of this to achieve sustainable development in the Kingdom.”

It is noteworthy that the project is expected to be operational in April 2024, as it is considered the largest solar energy project with an on-grid system in the Middle East and North Africa region, and it is the first of its kind in Jordan and the region in terms of its shareholders, which makes it a role model for more projects in the future.

The ability to make your cash payments by scanning a QR code.

30/08/2022

Through Safwa Mobile, you can now carry out your cash purchases through points of sale that provide the feature of paying using a QR code with ease and security, without the need to use any of your bank cards.

Join our family and open your bank account with ease and security.

21/08/2022

Now, through Safwa Mobile, you can open your bank account easily and securely anytime anywhere without the need to visit the branch, through simple steps to make you bank account ready for use, to know more about the steps, click here.